At Investment Sangam, we provide a comprehensive suite of financial and investment services tailored to your life goals. Whether you’re planning for the future or protecting your present.

Mutual funds allow you to invest in a diversified portfolio of stocks, bonds, and other assets, managed by professional fund managers. Whether your goal is growth, income.

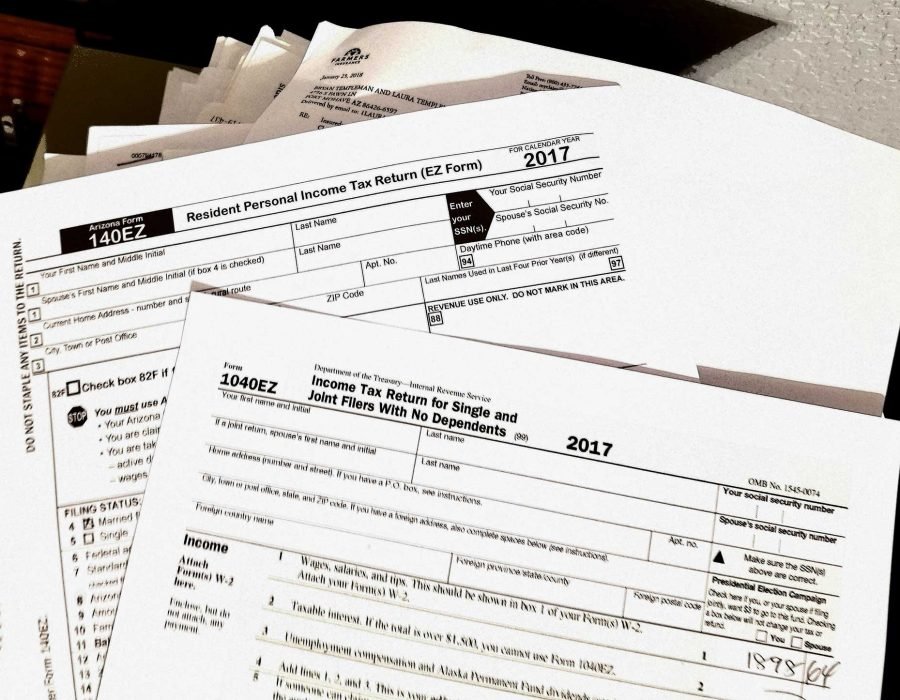

Tax-saving mutual funds that offer high growth potential with Section 80C benefits and a lock-in of just 3 years.

Life insurance policies provide financial security to your loved ones in case of unforeseen events. We offer trusted, professional, and personalized.

Get high-value life coverage at affordable premiums to safeguard your family’s future.

Plan a secure and independent retirement with smart investment strategies designed for long-term stability.

Invest today for your child’s tomorrow — education, marriage, and more — all planned in advance.

Stay financially prepared for medical emergencies with comprehensive health insurance coverage.

Cover yourself against unexpected accidents, disability, or income loss with low-cost, high-impact protection.

Secure, low-risk investments with guaranteed returns — ideal for steady savings and income.

We follow a simple, transparent, and result-oriented process to help you achieve your financial goals with ease and confidence.

Schedule a free consultation with our financial expert at your convenience — online or offline.

Discuss your goals, income, and needs with our experienced team to receive personalized financial recommendations.

We guide you through the best investment, insurance, or savings plan — so your financial future is secure and stress-free.

We’re here to help you make confident and informed financial decisions. Whether you’re exploring investment options, looking for the right insurance plan, or need guidance on retirement planning — our expert advisors are just a message away. Let’s discuss your goals and craft a solution that fits your life perfectly.

Lorem ipsum dolor sit amet consecte adipiscing elit sed do eiusmod

Lorem ipsum dolor sit amet consecte adipiscing elit sed do eiusmod

Lorem ipsum dolor sit amet consecte adipiscing elit sed do eiusmod

Powered By MBG Card Pvt. Ltd

Copyright © 2025 Investment Sangam. All rights reserved.